As we progress through 2024, the logistics market is experiencing a dynamic transformation. Key indicators show a blend of growth and challenges, reflecting an evolving landscape that logistics managers and industry stakeholders must navigate carefully. This article delves into the current state of the logistics market, highlighting critical data points and providing a deeper analysis of emerging trends.

Growth in Overall Spending

The Logistics Managers Index (LMI), a crucial metric for understanding logistics market dynamics, reflects an expanding sector. In May 2024, the LMI rose by 2.7 points to reach 55.6, up from the previous month. This increase signifies that the logistics industry is in an expansion phase, with logistics managers reporting higher levels of business activity and optimism. The positive shift in the LMI indicates robust growth and a favorable outlook for the sector, driven by increased demand for logistics services and improved economic conditions.

Transportation Prices: A Sharp Surge

Transportation costs are a significant concern for the logistics market. The Transportation Price component of the LMI saw a dramatic increase of 13.7 points, climbing to 57.8 in May. This is the highest level since June 2022, signaling a substantial rise in transportation costs. This surge can be attributed to several factors:

- Higher Fuel Prices: Fluctuations in fuel prices directly impact transportation costs. Recent increases in oil prices have contributed to higher fuel expenses for carriers.

- Increased Demand: A surge in consumer demand and e-commerce activity has strained transportation networks, pushing prices higher.

- Supply Chain Disruptions: Ongoing supply chain challenges, including port congestion and delays, have exacerbated transportation cost increases.

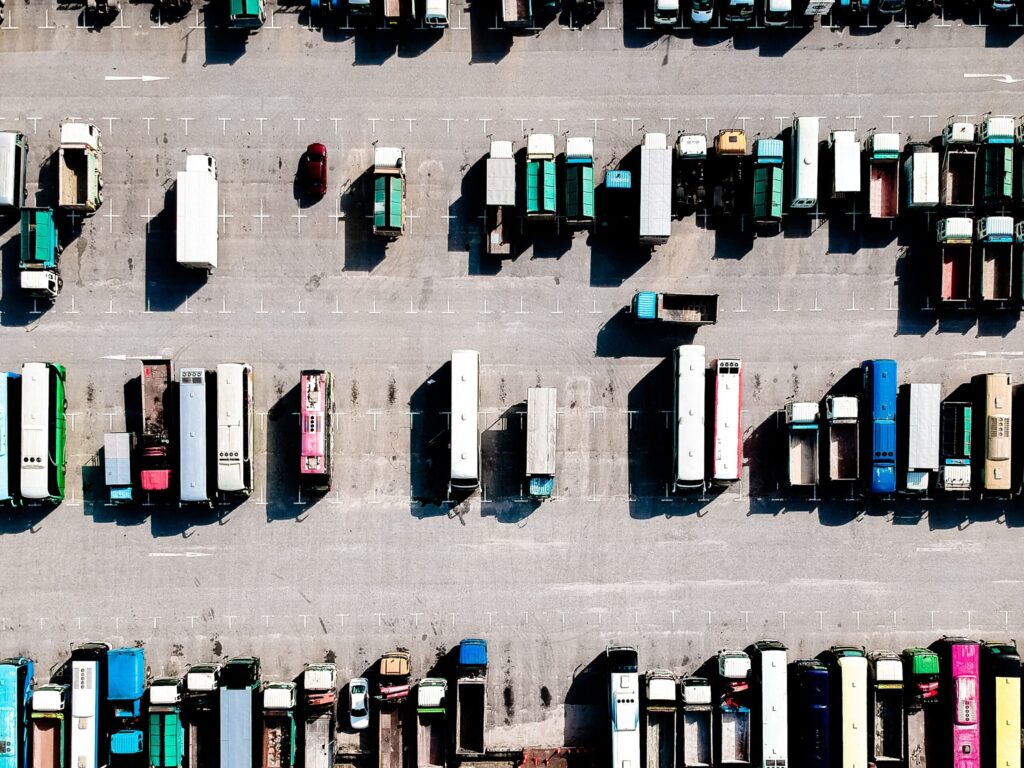

Record-Breaking Import Volumes

The U.S. logistics sector is witnessing unprecedented import volumes, with daily shipments reaching 78,000—the highest level in five years. This surge reflects several key trends:

- Resilient Consumer Demand: Strong consumer spending and economic recovery post-pandemic have driven high import volumes, particularly in retail and manufacturing sectors.

- Global Trade Activity: Increased global trade activity, particularly from major trading partners like China and the European Union, has contributed to higher import figures.

- Inventory Restocking: Many businesses are restocking inventories to meet anticipated demand, further boosting import volumes.

Shrinking Capacity: An Emerging Challenge

Despite the positive growth in spending and volume, the logistics market faces a critical challenge with shrinking capacity. Available-for-hire capacity has decreased to approximately +15% relative to market conditions, down from +18% in June 2022. This reduction in capacity is attributed to several factors:

- Labor Shortages: The logistics sector is grappling with labor shortages, including a lack of qualified truck drivers and warehouse staff, which impacts overall capacity.

- Infrastructure Limitations: Existing infrastructure limitations, including port congestion and inadequate warehousing facilities, are constraining available capacity.

- Regulatory Challenges: Increased regulatory requirements and compliance costs are affecting capacity and operational efficiency.

Future Outlook and Strategic Considerations

Looking ahead, the logistics market will likely continue to evolve, influenced by several key factors:

- Technological Advancements: Innovations in logistics technology, such as automation, artificial intelligence, and blockchain, are expected to enhance operational efficiency and address capacity constraints.

- Sustainability Trends: Growing emphasis on sustainability will drive investments in green logistics solutions, such as electric vehicles and eco-friendly packaging, aligning with broader environmental goals.

- Geopolitical Factors: Global geopolitical developments, including trade policies and international relations, will impact logistics operations and market dynamics.

Conclusion

The logistics market in 2024 is characterized by significant growth in spending and import volumes, alongside rising transportation costs and shrinking capacity. For logistics professionals and stakeholders, understanding these trends is crucial for strategic planning and operational success. Adapting to changing market conditions, leveraging technological advancements, and addressing capacity challenges will be key to navigating the evolving logistics landscape effectively. If you want to get some estimates, head to our tool here!